excise duty on crushed stone

Pebbles, Gravel, Broken Or Crushed Stone, Of A Kind ...

2022-1-19 · Pebbles, Gravel, Broken Or Crushed Stone, Of A Kind Commonly Used For Concrete Aggregates, For Road Metalling Or For Railway Or Other Ballast, Shingle And Flint, Whether Or Not Heat-treated; Macadam Of Slag, Dross Or Similar Industrial Waste, Whether Or N Search updated Central Excise Duty and Tariff of Years 2009, 2008, 2007 and 2006. Details of

Read More

Excise On Stone Crusher - risedelft.nl

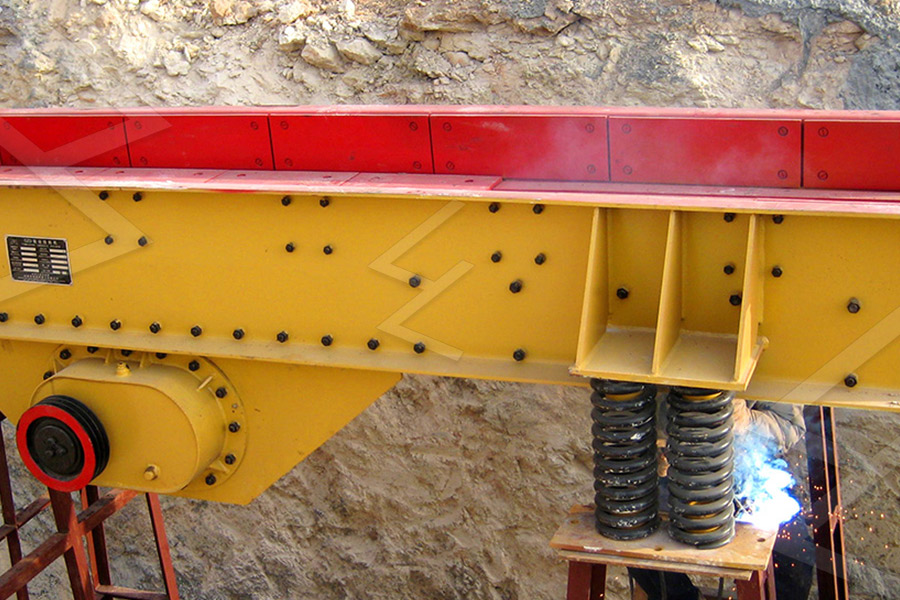

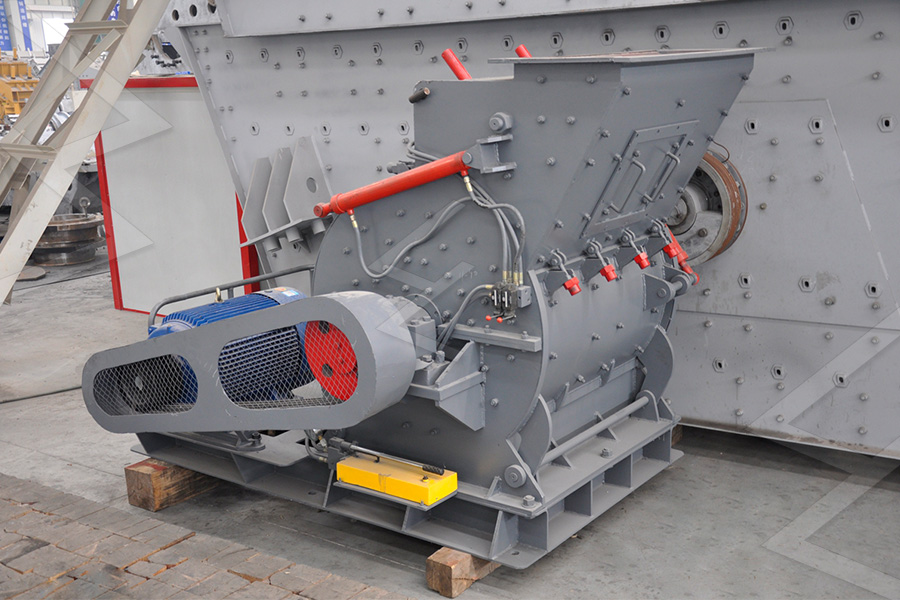

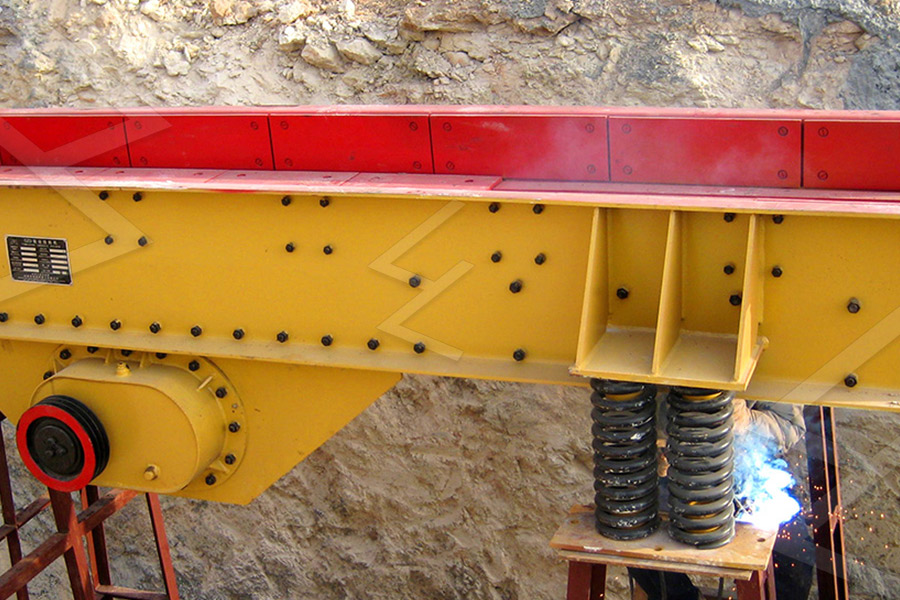

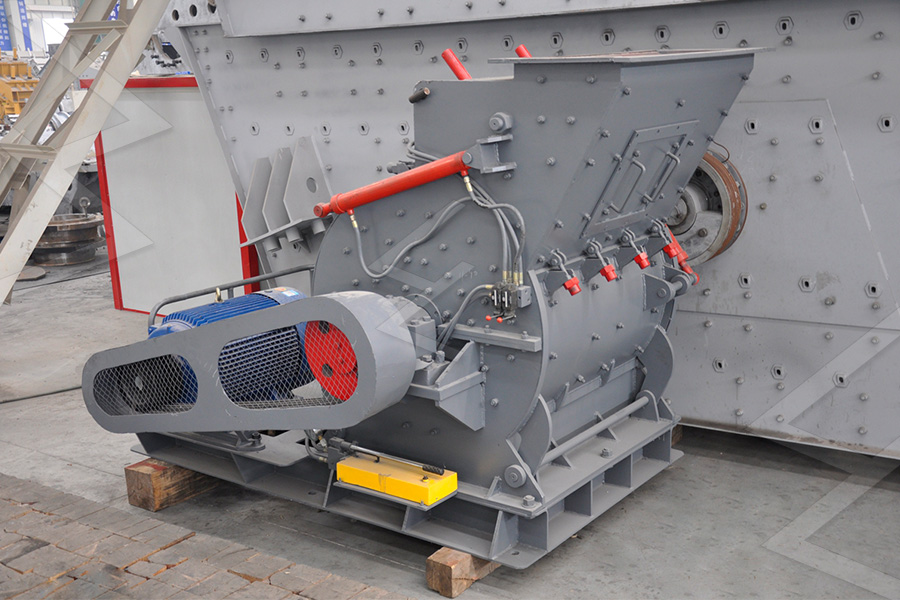

2021-12-20 · Excise Duty On Stone Crusher. Excise Duty On Stone Crusher. Excise duty on stone crusher,Our company is a large-scale heavy enterprise that taking heavy mining machinery manufactory as main products and integrated with scientific research, production, and marketing. Stone Crusher For Tractors Fae Usa. Stone Crushers.

Read More

excise duty on stone crusher import

Excise Duty On Stone Crusher westernriverranch-mg.de. Excise duty on stone crusher,Our company is a large-scale heavy enterprise that taking heavy mining machinery manufactory as main products and integrated with scientific research, production, and marketing.

Read More

25171010 - Pebbles, gravel, broken or crushed stone, of a ...

2022-1-4 · 25171010 - Pebbles, gravel, broken or crushed stone, of a kind commonly used for concrete aggregates, for road metalling or for railway or other ballast, shingle and flint, whether or not heat-treated: Pakur stone, crushed or broken Updated India Import Duty and Custom duty of Customs tariff of 2006, 2007, 2008 and 2009 in Single View.

Read More

Hindustan Construction Co. Ltd. vs Collector Of C. Ex. on ...

2016-5-5 · We hold that crushing of boulders into stones of smaller sizes amounts to manufacture and crushed stones are classifiable under Chapter 25 of CETA and chargeable to Central Excise duty. 7. The learned Senior Counsel has also contended that though only 30 per cent boulders were crushed into stones of small sizes, duty has been demanded on the ...

Read More

central excise duty for stone crusher

Central Excise Duty On Stone Crusher - as-autopflege.ch. Stone Crusher Excise Duty Applicable Or Not. Central excise tariff no of ball mill components Mar 1, 2006 under the First Schedule to the Central Excise Tariff Act, as is in excess of the amount calculated at the rate specified in the their components Chat Now central excise duty on stone crusher central excise duty on stone

Read More

Jaiprakash Industries Ltd. vs Commr. Of C. Ex. on 8 ...

Appeal No. E/1157/94-C has been filed against the Order-in-Original dated 25-2-1994 passed by the Collector in pursuance of the show cause notice dated 3-5-1993 relating to the period April, 1990 to September, 1991 vide he raised demand of Rs. 12,05,187/- as excise duty on the crushed stone and imposed personal penalty of Rs.1,50,000/- on the ...

Read More

Vat Ta Rate On Crusher In Binq Mining

2021-12-20 · Excise Duty On Stone Crusher. Excise duty on stone crusher,Our company is a large-scale heavy enterprise that taking heavy mining machinery manufactory as main products and integrated with scientific research, production, and marketing. ... vat tax rate on crusher in binq mining vat applicable on crushed stone aggregates in india th th stone ...

Read More

vat applicable on crushed stone aggregates in india

GST Tax Rate on HSN Product 25171010 Pebbles Gravel . 25171010 Pebbles Gravel Broken Or Crushed Stone Of A Kind Commonly Used For Concrete Aggregates For Road Metalling Or For Railway Or Other Ballast Shingle And Flint Whether Or Not Heat Treated Macadam Of Slag Dross Or Similar Industrial Waste Whether Or Not Incorporating The Materials Cited In The First Part

Read More

Excise Duty on Jewellery - A Critique | Indirect Tax

2022-1-27 · When excise duty was imposed on jewellery w.e.f. 1 st March 2016, it set in motion a chain of events ranging from rallies to closure of shops. As the protests continued in variety of forms, the Government got into the ring and left no stone unturned to soften the blow. However, there is nothing new in the design.In 2005, Government imposed excise duty on branded

Read More

Hindustan Construction Co. Ltd. vs Collector Of C. Ex. on ...

2016-5-5 · We hold that crushing of boulders into stones of smaller sizes amounts to manufacture and crushed stones are classifiable under Chapter 25 of CETA and chargeable to Central Excise duty. 7. The learned Senior Counsel has also contended that though only 30 per cent boulders were crushed into stones of small sizes, duty has been demanded on the ...

Read More

Vat Ta Rate On Crusher In Binq Mining

2021-12-20 · Excise Duty On Stone Crusher. Excise duty on stone crusher,Our company is a large-scale heavy enterprise that taking heavy mining machinery manufactory as main products and integrated with scientific research, production, and marketing. ... vat tax rate on crusher in binq mining vat applicable on crushed stone aggregates in india th th stone ...

Read More

Central excise - Official Website of Authority for Advance ...

Whether in the facts and circumstances of the present case, the process of crushing of coal amount to manufacturing activity in the context of Central Excise Act 1944 and whether the applicant is liable to pay Excise Duty on the clearance of crushed coal from its factory? Ruling No. AAR/CE/15/2016 dt.13.05.2016

Read More

vat applicable on crushed stone aggregates in india

GST Tax Rate on HSN Product 25171010 Pebbles Gravel . 25171010 Pebbles Gravel Broken Or Crushed Stone Of A Kind Commonly Used For Concrete Aggregates For Road Metalling Or For Railway Or Other Ballast Shingle And Flint Whether Or Not Heat Treated Macadam Of Slag Dross Or Similar Industrial Waste Whether Or Not Incorporating The Materials Cited In The First Part

Read More

Crushed Stone & Gravel BID #105007

2008-8-18 · Crushed Stone and Gravel. BID OPENING Sealed bids will be opened at 2:00 p.m., January 31, 2005, at the Dane County Purchasing Division, 210 Martin Luther King Jr. Blvd., Room 425A, Madison, WI 53703-3345. BID BOND/PERFORMANCE BOND No bid bond or performance bond is required. STATE SALES TAX/FEDERAL EXCISE TAX

Read More

Excise Duty on Jewellery - A Critique | Indirect Tax

2022-1-27 · When excise duty was imposed on jewellery w.e.f. 1 st March 2016, it set in motion a chain of events ranging from rallies to closure of shops. As the protests continued in variety of forms, the Government got into the ring and left no stone unturned to soften the blow. However, there is nothing new in the design.In 2005, Government imposed excise duty on branded

Read More

M/S. VINAYAK STONE CRUSHER – GST Mitra

2021-9-28 · Classification of services – service provided in accordance with Notification No. 11/2017-CT (Rate) dated 28.06.2017 read with annexure attached to it by the State of Rajasthan to M/S Vinayak Stone Crusher for which royalty is being paid – HELD THAT:- The service provided by the State of Rajasthan to the applicant for which royalty is being paid is

Read More

Taxing construction minerals

2016-11-18 · is proposed in the following – a tax on primary construction minerals. 1.2 Impacts of sand, gravel, crushed rock and limestone extraction and use From the beginning of the value chain the mining and use of construction materials such as sand, gravel, crushed stone and limestone has direct and indirect environmental impacts and consequences.

Read More

INPUT TAX CREDIT FOR MINING & CRUSHING

Sir, As per sl. No. 126 of Schedule I of Notification No. 1/2017-Central Tax (Rate) dated 28.6.2017 "Pebbles, gravel, broken or crushed stone, of a kind commonly used for concrete aggregates, for road metalling or for railway or other ballast, shingle and flint, whether or not heat-treated; macadam of slag, dross or similar industrial waste, whether or not incorporating the materials

Read More

AMENDMENTS VIDE THE FINANCE ACT, 2021 – Junaidy

Excise duty on mobile phone call (Serial no. 6A, Table II, First Schedule) The Finance bill proposed to charged additional excise duty at the rate of one rupee per call if call duration exceeds three minutes. The Finance Act has reduced such additional excise duty to seventy five paisa per call and also extended the call duration to five minutes.

Read More

Vat Ta Rate On Crusher In Binq Mining

2021-12-20 · Excise Duty On Stone Crusher. Excise duty on stone crusher,Our company is a large-scale heavy enterprise that taking heavy mining machinery manufactory as main products and integrated with scientific research, production, and marketing. ... vat tax rate on crusher in binq mining vat applicable on crushed stone aggregates in india th th stone ...

Read More

Chapter 25 Salt; sulphur; earths and stone; plastering ...

2021-7-29 · Preferential Duty S C L Gen Duty VAT PAL Cess Excise (S.P.L) 25.17 Pebbles, gravel, broken or crushed stone, of a kind commonly used for concrete aggregates, for road metalling or for railway or other ballast, shingle and flint, whether or not heat-treated; macadam of slag, dross or similar industrial waste, whether or not

Read More

Crushed Stone & Gravel BID #105007

2008-8-18 · Crushed Stone and Gravel. BID OPENING Sealed bids will be opened at 2:00 p.m., January 31, 2005, at the Dane County Purchasing Division, 210 Martin Luther King Jr. Blvd., Room 425A, Madison, WI 53703-3345. BID BOND/PERFORMANCE BOND No bid bond or performance bond is required. STATE SALES TAX/FEDERAL EXCISE TAX

Read More

SECTION V - cbic.gov

2021-5-25 · OF STONES OF HEADING 2515 OR 2516, WHETHER OR NOT HEAT-TREATED 2517 10 ííí-Pebbles, gravel, broken or crushed stone, of a kind commonly used for concrete aggregates, for road metalling or for railway or other ballast, shingle and flint, whether or not heat-treated: 2517 10 10 í--- Pakur stone, crushed or broken kg. Nil 2517 10 20 í ...

Read More

FIJI REVENUE & CUSTOMS AUTHORITY PUBLIC

2018-4-9 · roads, an export duty of 5% will be imposed on the exportation of pebbles, gravels, broken or crushed stone commonly used for concrete aggregates and road metalling. In addition, High Bin Dumper trucks with a gross vehicle weight exceeding 20 tonnes will now be prohibited except for the trucks being imported for mining purposes. 2

Read More

Excise Duty on Jewellery - A Critique | Indirect Tax

2022-1-27 · When excise duty was imposed on jewellery w.e.f. 1 st March 2016, it set in motion a chain of events ranging from rallies to closure of shops. As the protests continued in variety of forms, the Government got into the ring and left no stone unturned to soften the blow. However, there is nothing new in the design.In 2005, Government imposed excise duty on branded

Read More

Taxing construction minerals

2016-11-18 · is proposed in the following – a tax on primary construction minerals. 1.2 Impacts of sand, gravel, crushed rock and limestone extraction and use From the beginning of the value chain the mining and use of construction materials such as sand, gravel, crushed stone and limestone has direct and indirect environmental impacts and consequences.

Read More

Rate of GST on Ramming Mass & crushed quartz stones

2018-9-1 · Further he has stated that crushed Quartz stone is to be classified under chapter heading no. 2506 and to be taxed at 5% under GST. He stated that crushed quartz stone on standalone basis cannot be used as a lining of furnace and qualify the Tariff head no. 2506 and GST rate of 5%. 5. Findings , Analysis and Conclusion:

Read More

Miscellaneous Tax Descriptions | Department of Finance

2 天前 · Home Excise Tax Miscellaneous Tax Miscellaneous Tax Descriptions. Miscellaneous Tax Descriptions. 1. Alcoholic Beverage Taxes Arkansas Code Annotated §§3-7-104, 3-5-409, 3-7-11. Excise tax is imposed on the first sale in the State and must be paid by the wholesaler and/or manufacturer of liquor, beer or wine distributor making the first sale.

Read More

AMENDMENTS VIDE THE FINANCE ACT, 2021 – Junaidy

Excise duty on mobile phone call (Serial no. 6A, Table II, First Schedule) The Finance bill proposed to charged additional excise duty at the rate of one rupee per call if call duration exceeds three minutes. The Finance Act has reduced such additional excise duty to seventy five paisa per call and also extended the call duration to five minutes.

Read More

- << Previous:Making Crushers And Jaw Crushers

- >> Next:600th Cone Crushing Plant In Qatar