soybean crush spread arbitrage

Soybean Futures Crush Spread Arbitrage: Trading

2010-12-31 · This paper revisits the soybean crush spread arbitrage work of Simon (1999) by studying a longer time period, wider variety of entry and exit limits, and the risk-return relationship between entry and exit limits. The lengths of winning and losing trades are found to differ systematically, with winning trades significantly shorter on average than losing trades.

Read More

Soybean Crush Spread Arbitrage: Trading Strategies and ...

2022-1-15 · This paper revisits the soybean crush spread arbitrage work of Simon (JFM, 1999). Major findings are that contrary to the results reported by

Read More

Soybean Crush Spread Arbitrage: Trading Strategies and ...

2007-5-18 · This paper revisits the soybean crush spread arbitrage work of Simon (JFM, 1999). Major findings are that contrary to the results reported by Simon, the length of winning and losing trades differ systematically. Winning trades are significantly shorter on average than losing trades.

Read More

Soybean Futures Crush Spread Arbitrage: Trading

Downloadable! This paper revisits the soybean crush spread arbitrage work of Simon (1999) by studying a longer time period, wider variety of entry and exit limits, and the risk-return relationship between entry and exit limits. The lengths of winning and losing trades are found to differ systematically, with winning trades significantly shorter on average than losing trades.

Read More

The Profitability of Crush Spread: Statistical Arbitrage ...

The paper takes soybean, soybean meal and soybean oil futures listed on the Dalian Commodity Exchange, rapeseed, rapeseed meal and rapeseed oil futures listed on the Zhengzhou Commodity Exchange as research objects. Based on the statistical arbitrage model, empirical studies on two kinds of crush arbitrage are conducted.

Read More

The Profitability of Crush Spread: Statistical Arbitrage ...

The Profitability of Crush Spread: Statistical Arbitrage Method . Quan Gu *, Xinghui Lei . School of Economics and Management, Tongji University, Shanghai, 200092, China *[email protected] . Keywords: Spread trading, Cursh spread, GARCH model . Abstract: This paper examines the crush arbitrage of soybean and rapeseed futures, which is based

Read More

Soybean Futures Crush Spread Arbitrage: Trading

Download PDF: Sorry, we are unable to provide the full text but you may find it at the following location(s): https://doi.org/10.3390/jrfm30... (external link)

Read More

Understanding Crushing and Crush Spread Margins of

2021-12-21 · The crush spread is the difference between the value of soybeans and its byproducts, and is an important tool to evaluate the potential profit margin for soybean processors. Generally 18% of Soy oil is recovered on crushing of soybean oil and the balance 82% is soy meal. Soybean is cracked during the crushing process so that the hull is removed ...

Read More

CBOT Soybean Crush - KIS FUTURES

2013-4-18 · soybean meal and soybean oil. The crush spread is a dollar value quoted as the difference between the combined sales values of the products and the cost of the raw soybeans. This value is traded in the cash or futures market based on expectations of future price movement of soybeans versus the

Read More

Crush Spread - Investopedia

2020-10-29 · Crush Spread: A trading strategy used in the soybean futures market. A soybean crush spread is often used by traders to manage risk by combining soybean, soybean oil and soybean meal futures ...

Read More

Soybean Futures Crush Spread Arbitrage: Trading

Download PDF: Sorry, we are unable to provide the full text but you may find it at the following location(s): https://doi.org/10.3390/jrfm30... (external link)

Read More

Understanding Crushing and Crush Spread Margins of

2021-12-21 · The crush spread is the difference between the value of soybeans and its byproducts, and is an important tool to evaluate the potential profit margin for soybean processors. Generally 18% of Soy oil is recovered on crushing of soybean oil and the balance 82% is soy meal. Soybean is cracked during the crushing process so that the hull is removed ...

Read More

Arbitrage Trading | FCATTLE/SOYB - The Efficiency Analysis ...

2020-6-12 · Meanwhile, soybean demand reduction is possible to happen, as soy is considered to be a cheaper substitute for meat protein. A further rise in the spread price to the upper boundary of range is expected. The main risk factor for beef

Read More

Understanding the Soybean Crush - Traders' Academy

Spread trading, which involves simultaneously buying and selling two different contracts, is a widespread strategy in the grain and oilseed markets. One of the most common spread trades in the soybean market is the crush spread.

Read More

Widening Argentina-Brazil soybean cash spread opens

2019-2-7 · Soybean Crush Dashboard. Commitment of Trade. Crop Calendar. Search . Soybean Market. Widening Argentina-Brazil soybean cash spread opens arbitrage . 7 Feb 2019 | Andy Allan. The widening spread between the price of Argentinian and Brazilian soybean cash prices at ports is tempting...

Read More

Crush Spread - Investopedia

2020-10-29 · Crush Spread: A trading strategy used in the soybean futures market. A soybean crush spread is often used by traders to manage risk by combining soybean, soybean oil and soybean meal futures ...

Read More

Soybean Crush Prices and Soybean Crush Futures Prices ...

grains Futures News. Corn prices rallied on Wednesday ending the session back above the $6 mark. For old crop, the session ended 10 3/4 to 11 cents in the black but went home... The double digit bounce back for Wobble Wednesday ended with beans 1.74% to 2.2% in the black. March beans closed with 30 cent gains.

Read More

Overview of U.S Crush Industry - NOPA

2017-6-5 · 94% of US soybean crush •Operate 64 processing plants in 20 states, including 58 that process soybeans •Crush 1.77 billion bushels, comprising over 45% of U.S. soybean farmers’ production in 2015/16 2

Read More

2022 CFA Level I Exam: Learning Outcome Statements

A. crack spread B. spark spread C. crush spread. Correct Answer: C. It is a trading strategy used in the soybean futures market. A soybean crush spread is often used by traders to manage risk by combining soybean, soybean oil and soybean meal futures positions, into a single position.

Read More

TED Tandems: Arbitrage Restrictions and the US Treasury ...

"Soybean Futures Crush Spread Arbitrage: Trading Strategies and Market Efficiency," Journal of Risk and Financial Management, MDPI, Open Access Journal, vol. 3(1), pages 1-34, December. Most related items These are the items that most often cite the same works as this one and are cited by the same works as this one.

Read More

Arbitrage Trading | FCATTLE/SOYB - The

2020-6-12 · Meanwhile, soybean demand reduction is possible to happen, as soy is considered to be a cheaper substitute for meat protein. A further rise in the spread price to the upper boundary of range is expected. The main risk factor

Read More

Understanding the Soybean Crush - Traders' Academy

Spread trading, which involves simultaneously buying and selling two different contracts, is a widespread strategy in the grain and oilseed markets. One of the most common spread trades in the soybean market is the crush spread.

Read More

Understanding Crushing and Crush Spread Margins of

2021-12-21 · The crush spread is the difference between the value of soybeans and its byproducts, and is an important tool to evaluate the potential profit margin for soybean processors. Generally 18% of Soy oil is recovered on crushing of soybean oil and the balance 82% is soy meal. Soybean is cracked during the crushing process so that the hull is removed ...

Read More

Crush Spread - Investopedia

2020-10-29 · Crush Spread: A trading strategy used in the soybean futures market. A soybean crush spread is often used by traders to manage risk by combining soybean, soybean oil and soybean meal futures ...

Read More

CBOT Soybean Crush - KIS FUTURES

2013-4-18 · soybean meal and soybean oil. The crush spread is a dollar value quoted as the difference between the combined sales values of the products and the cost of the raw soybeans. This value is traded in the cash or futures market based on expectations of future price movement of soybeans versus the

Read More

Soybean Trading Strategies - Top 3 Methods You Need to

2021-7-17 · Learn 3 unique soybean trading strategies that you must know if you want to trade on one of the most promising commodity markets out there. Developing a successful commodities trading strategy is one of the best ways to increase your daily ROI. Throughout this guide, you’ll learn how to trade soybeans, when is the best time to buy and sell soybeans, what is a grain

Read More

Soybean Crush Prices and Soybean Crush Futures Prices ...

grains Futures News. Corn prices rallied on Wednesday ending the session back above the $6 mark. For old crop, the session ended 10 3/4 to 11 cents in the black but went home... The double digit bounce back for Wobble Wednesday ended with beans 1.74% to 2.2% in the black. March beans closed with 30 cent gains.

Read More

How To Trade Futures Spreads Profitably -

2020-1-13 · As an example, Sam could buy soybean futures and sell soybean oil futures to execute a “Soybean Crush” commodity product spread. Though spread strategies vary greatly, almost all fall within these three categories. If you were

Read More

Box Spread Arbitrage Profits following the 1987 Market ...

Box Spread Arbitrage Profits following the 1987 Market Crash: Real or lllusory? Michael L. Hemler and Thomas W. Miller, Jr.* Abstract We examine market efficiency before and after the 1987 Market Crash using the box spread strategy implemented with European-style S&P 500 Index (SPX) options. Before the Crash,

Read More

Futures Spread Trading - Guide on How to Trade Spreads

2020-9-18 · Futures spread is a trading technique where you open a long and a short position simultaneously to take advantage of a price discrepancy. The idea behind futures spread trading strategies is to reduce the risk. At the same time, it allows you to capitalize on the pricing inefficiencies for one or several instruments.

Read More

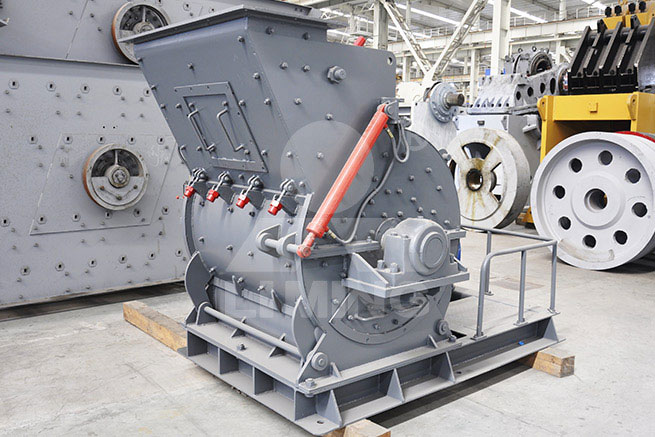

- << Previous:Haul Truck In The Copper Mining

- >> Next:Used Mining Crusher For Sale South Africa