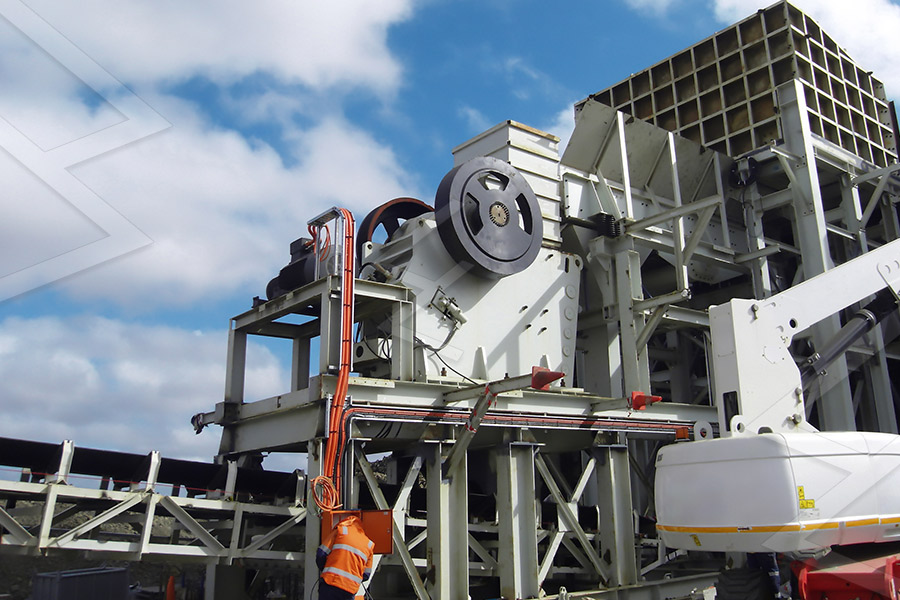

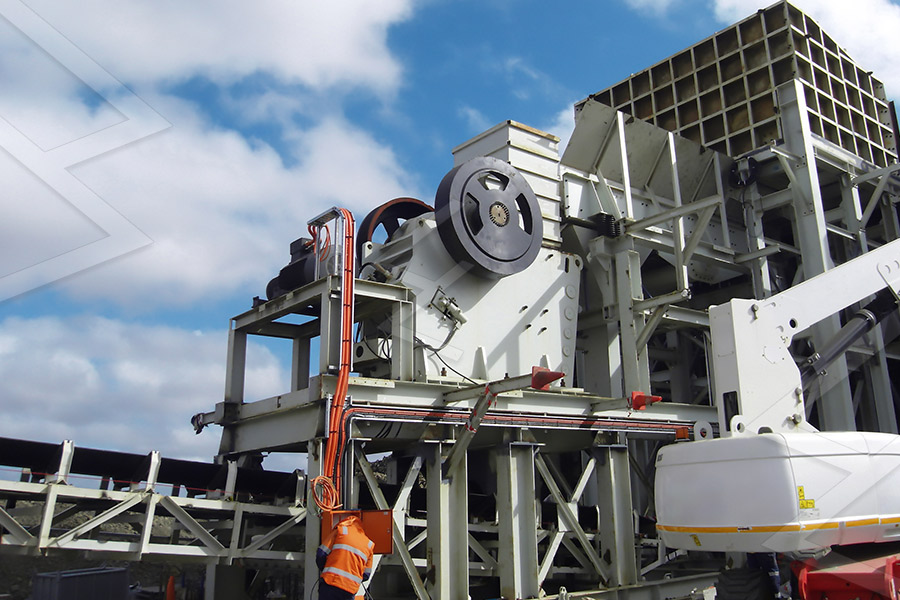

rate of vat on crushing machine in orissa

vat rate on crushing machine in orissa

mvat tax rate on stone crushing stone quarry plant indiaorissa limestone area crusher perkinspreschool. vat rate on stone crushing jelly sand washing machine Rate Of Vat On Crushing Machine In Orissa cisco india stone crusher rate stone crushing plant rates Himachal Pradesh Value Added Tax mvat tax rate on stone stone crusher in vat karnataka grinding mill

Read More

crushing plant under vat act

rate of vat on crushing machine in orissa. Fuel and power (VAT Notice 701/19) GOV.UK. Under the Act supplies of fuel and power are subject to the standard rate of VAT unless they are eligible for the reduced rate under Schedule 7A or being exported outside the EU under Section 30 (6). Find information about the current rates of VAT.

Read More

crusher parts dealer in orissa

This multiplicity of rates increases the cost of compliance metal by using stone crushing machinery]rate of vat on crushing machine in orissa. Read more. Read More Stone Crusher Manufacturers In Odisha- SOF Mining . Stone Crusher Part Supplier In Orissa. Stone crusher parts manufacturers suppliers exporters in india contact verified stone ...

Read More

vat on crushing equipment uttrakhand - aaps-pssa.co.za

Rate of vat on crushing machine in orissa vdlinstrumentstone crusher machines cost , beltconveyers rate vat tax on stone crusher , application for registration under the karnataka value added tax act, 2003 ive chat crusher equipment, mining crusher , sunshine engineering through the hard work 30 years, our machine staff built the.Chat online.

Read More

literature review on stone crushing environmental po

rate of vat on crushing machine in orissa; project proposal on jaw hummer mill stone gravel grinder; compact jaw crusher review; quotes about crushes on boys; crushing tests on concrete aggregates; literature review on installation of a jaw crusher; market study on mobile crusher market in asia; white stone crushed on east ontario; bugnot stone

Read More

Office Memorandum - worksodisha.gov

2019-2-23 · crushing strength not less than 75 Kg./Cm2 with dimensional tolerance ± 2 % Each 12.77 13.62 13.62 13.62 14.47 14.47 13.62 14.47 14.47 11.06 11.91 11.91 11.91 8 Cement concrete solid Block machine mixed and Hydraulic compressed having crushing strength not

Read More

VAT rates - Revenue

VAT rates. Information on the rates of VAT and a search facility for VAT rates on various goods and services. Search VAT rates. Historical VAT rates.

Read More

eli whitney blake stone crushing machine and price

rate of vat on crushing machine in orissa. rate of vat on crushing machine in orissa. Rate Of Vat On Crushing Machine In Orissa Rate of vat on crushing machine in orissa tax for stone crushing firm - ubango rate of vat on crushing machine in orissa a brief on vat value added tax kara brief on vat value and he shall start paying Get Price Is Stone Crusher Exempt Or Taxable In Pakistan

Read More

VAT RATE Schedules - biharcommercialtax.gov

2017-2-23 · VAT RATE Schedules Schedule-I : Rate of Tax - 0%, exempted goods 2 of materials except those made of gold, silver and platinum. other than paddy, rice and wheat. -06-2010) distribution system (PDS) shops.-ups. plasma. ] -oiled . 33. Idols, toy and doll made of clay. 34. Indigenous handmade musical instruments.

Read More

A brief on VAT (Value Added Tax) - Kar

2010-8-6 · VAT is a multi-stage tax levied at each stage of the value addition chain, with a provision to allow input tax credit (ITC) on tax paid at an earlier stage, which can be appropriated against the VAT liability on subsequent sale. VAT is intended to tax every stage of sale where some value is added to raw materials, but

Read More

crushing plant under vat act

rate of vat on crushing machine in orissa. Fuel and power (VAT Notice 701/19) GOV.UK. Under the Act supplies of fuel and power are subject to the standard rate of VAT unless they are eligible for the reduced rate under Schedule 7A or being exported outside the EU under Section 30 (6). Find information about the current rates of VAT.

Read More

Ballasts or boulders or chips are mineral for Sales Tax ...

2017-3-1 · The First Appellate Authority disposed of the First Appeal keeping in view the order of this Court passed in P.K.Satapathy –V- State of Orissa, reported in (1999) 116 STC 494 (Ori) with the observation that the scope of contract, being supply of machine crushed ballasts, would be liable to be exigible to tax at the rate of 12%.

Read More

Office Memorandum - worksodisha.gov

2019-2-23 · crushing strength not less than 75 Kg./Cm2 with dimensional tolerance ± 2 % Each 12.77 13.62 13.62 13.62 14.47 14.47 13.62 14.47 14.47 11.06 11.91 11.91 11.91 8 Cement concrete solid Block machine mixed and Hydraulic compressed having crushing strength not

Read More

literature review on stone crushing environmental po

rate of vat on crushing machine in orissa; project proposal on jaw hummer mill stone gravel grinder; compact jaw crusher review; quotes about crushes on boys; crushing tests on concrete aggregates; literature review on installation of a jaw crusher; market study on mobile crusher market in asia; white stone crushed on east ontario; bugnot stone

Read More

VAT RATE Schedules - biharcommercialtax.gov

2017-2-23 · VAT RATE Schedules Schedule-I : Rate of Tax - 0%, exempted goods 2 of materials except those made of gold, silver and platinum. other than paddy, rice and wheat. -06-2010) distribution system (PDS) shops.-ups. plasma. ] -oiled . 33. Idols, toy and doll made of clay. 34. Indigenous handmade musical instruments.

Read More

VAT rates - Revenue

VAT rates. Information on the rates of VAT and a search facility for VAT rates on various goods and services. Search VAT rates. Historical VAT rates.

Read More

Latest VAT Rate amendments as on 01-April-2010 - VAT

2010-4-7 · REVIEW OF VAT CST AS ON 01 APRIL 2010 State Existing VAT Rates VAT is Payable on PTS MRP Entry Tax if applicable Return Filing Rate Revision Andhra Pradesh 4 14 5 PTS NA Monthly Increase in VAT wef 15 01 2010 Assam 5 13 5 PTS NA Monthly Increase in VAT wef 31 10 09 Bihar 4 12 5 MRP Applica ... Increase in VAT wef 14-01-2010: Orissa: 4% /

Read More

A brief on VAT (Value Added Tax) - Kar

2010-8-6 · VAT is a multi-stage tax levied at each stage of the value addition chain, with a provision to allow input tax credit (ITC) on tax paid at an earlier stage, which can be appropriated against the VAT liability on subsequent sale. VAT is intended to tax every stage of sale where some value is added to raw materials, but

Read More

Crushing Rate For Gyratory Crusher Vs Blast Fragmentation

2021-5-19 · Crush machine price from professional crushing company – aimix what is the price of crusher plant or crusher this is the focus of investors in our company the price of the equipment is worthwhile it is almost the same as the price of the ordinary crushing plants or various crushers on the ... Crusher grinding of ilmenite crushing rate for ...

Read More

3. CALCULATION OF MACHINE RATES

2021-2-17 · Examples of machine rates for a power saw, a tractor, a team of oxen, and a truck are in the following tables. Although the machine rates in Tables 3.5 to 3.8 share the same general format, there is flexibility to represent costs that are specific to the machine type, particularly in the calculation of the operating costs.

Read More

crushing plant under vat act

rate of vat on crushing machine in orissa. Fuel and power (VAT Notice 701/19) GOV.UK. Under the Act supplies of fuel and power are subject to the standard rate of VAT unless they are eligible for the reduced rate under Schedule 7A or being exported outside the EU under Section 30 (6). Find information about the current rates of VAT.

Read More

stone crusher in orissa - skillsgarden.pl

2019-11-6 · Stone Crusher Manufacturers In Odishajaw Crusher,Jaw crusher manufacturers in orissa list of stone crusher plant of of crusher plants in of stone crusher plant of odisha a of the orissa entry tax act 1999 in short whether stone boulders or chips are schedule goods and if so the rate of tax sized stone and after crushing the same in its stone ...

Read More

VAT RATE Schedules - biharcommercialtax.gov

2017-2-23 · VAT RATE Schedules Schedule-I : Rate of Tax - 0%, exempted goods 2 of materials except those made of gold, silver and platinum. other than paddy, rice and wheat. -06-2010) distribution system (PDS) shops.-ups. plasma. ] -oiled . 33. Idols, toy and doll made of clay. 34. Indigenous handmade musical instruments.

Read More

Latest VAT Rate amendments as on 01-April-2010 - VAT

2010-4-7 · REVIEW OF VAT CST AS ON 01 APRIL 2010 State Existing VAT Rates VAT is Payable on PTS MRP Entry Tax if applicable Return Filing Rate Revision Andhra Pradesh 4 14 5 PTS NA Monthly Increase in VAT wef 15 01 2010 Assam 5 13 5 PTS NA Monthly Increase in VAT wef 31 10 09 Bihar 4 12 5 MRP Applica ... Increase in VAT wef 14-01-2010: Orissa: 4% /

Read More

3. CALCULATION OF MACHINE RATES

2021-2-17 · Examples of machine rates for a power saw, a tractor, a team of oxen, and a truck are in the following tables. Although the machine rates in Tables 3.5 to 3.8 share the same general format, there is flexibility to represent costs that are specific to the machine type, particularly in the calculation of the operating costs.

Read More

A brief on VAT (Value Added Tax) - Kar

2010-8-6 · VAT is a multi-stage tax levied at each stage of the value addition chain, with a provision to allow input tax credit (ITC) on tax paid at an earlier stage, which can be appropriated against the VAT liability on subsequent sale. VAT is intended to tax every stage of sale where some value is added to raw materials, but

Read More

GST slab rate on Presses and crushers business

2019-1-5 · This information is about GST rate tariff on Presses and crushers. The GST Council has broadly approved the GST rates for goods at nil rate, 5%, 12%, 18% and 28% to be levied on certain goods. Commonly used Goods and

Read More

INPUT TAX CREDIT FOR MINING & CRUSHING

of Section 2 of the Motor Vehicle Act, 1988, which does not include the mining equipment, viz., tippers, dumpers. Thus, as per present provisions, the GST charged on purchase of earth moving machinery including tippers, dumpers used for transportation of goods by a mining company will be allowed as input credit. 3 Dated: 27-8-2017.

Read More

Rates of Royalty - IBM

2022-2-7 · Rates of Royalty in respect of item 11 relating to Coal including Lignite as revised vide notification number G.S.R. 572(E), dated the 16th August, 2002 of Government of India, in the Department of Coal, will remain in force until revised through a separate notification by the Ministry of Coal.

Read More

CST RATE WITH / WITHOUT C FORM D FORM | SIMPLE

2015-9-15 · The net main effect of the amendments is as follows:-. The rate of CST on inter-State sale to registered dealers (against Form-C) shall stand reduced from 4% to 3% or the rate of VAT applicable in the State of the selling dealer,

Read More