central excise duty on stone crusher

84742010 - For stone and mineral Central Excise Duty and ...

2022-1-14 · 84742010 - For stone and mineral Search updated Central Excise Duty and Tariff of Years 2009, 2008, 2007 and 2006. Details of Modvat and cenvat.

Read More

excise duty on stone crusher import

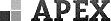

Central Excise Rebate From Re Rolling Mill, stone crusher excise duty applicable, labelled diagram of a hammer mills all new registrations central excise and More information new budget for excise duty on rolling mills Changes in excise duty as per Indian Budget, Changes in excise duty as per Indian Budget 201617 for machinery.

Read More

Excise On Stone Crusher - risedelft.nl

2021-12-20 · Central Excise Duty On Stone Crusher. Central excise notifi ion regarding crusher machine central excise duty on stone crusher crusher unit tariff heading for grinding machine metal testing machine get price and support online ssi units exemption under central excise caclubindia notification no82003 provides relaxation to ssi units from central .

Read More

central excise duty for stone crusher

Central Excise Duty On Stone Crusher - as-autopflege.ch. Stone Crusher Excise Duty Applicable Or Not. Central excise tariff no of ball mill components Mar 1, 2006 under the First Schedule to the Central Excise Tariff Act, as is in excess of the amount calculated at the rate specified in the their components Chat Now central excise duty on stone crusher central excise duty on stone

Read More

84742010 - Crushing or grinding machines: For stone and ...

2022-1-20 · 84742010 - Crushing or grinding machines: For stone and mineral Updated India Import Duty and Custom duty of Customs tariff of 2006, 2007, 2008 and 2009 in Single View.

Read More

Central excise - Official Website of Authority for Advance ...

11 行 · Central excise. 1) Whether produced ‘blended metal scrap’ can be classifiable under

Read More

M/S. Sanjeev Stone Crushing Company v. State Of Haryana ...

“10. For availing the credit of duty, what is required to be established under Rule 57G is that the inputs received are infact duty paid. The procedure set out in Rule 57G of the Central Excise Rules is to ensure that the credit is taken on the basis of duty paid documents. The bill of entry is one such document set out in Rule 57G.

Read More

INPUT TAX CREDIT FOR MINING & CRUSHING

Sir, As per sl. No. 126 of Schedule I of Notification No. 1/2017-Central Tax (Rate) dated 28.6.2017 "Pebbles, gravel, broken or crushed stone, of a kind commonly used for concrete aggregates, for road metalling or for railway or other ballast, shingle and flint, whether or not heat-treated; macadam of slag, dross or similar industrial waste, whether or not incorporating the materials

Read More

J.P. Stone Crusher (P) Ltd, ... vs Department Of Income Tax

The ground raised is that ld. CIT(A) erred in deleting addition of Rs. 1836804/- on account of claim u/s 80IB ignoring the fact that assessee is a stone crusher and not manufacturer at all, and also in ratio of decision in the case of Lucky Minmat Pvt. Ltd. vs. CIT 116 Taxman 1 (SC) and other case laws on the subject.

Read More

M/S. Tega India Ltd vs Commissioner, Central Excise ...

An identical view has also been taken by this Court in the case of Collector of Central Excise vs. Technoweld Industries reported in 2003 (155) E.L.T. 209 (S.C.), wherein this Court has held that wires drawn from duty paid wire rods were not a different product and that they were not excisable even though they fell under two separate entries.

Read More

Stone Crusher In Ghana - kexmd Mining Machinery

Excise duty on stone crusher import polarstudie excise duty for mobile crushers regalcollege central excise duty on stone crusher central excise duty on stone crusher rock crusherand mine solution mobile rock impact crusher plant price know more 1311 crusher canyon rd selah wa public record trulia 1311 crusher canyon rd selah wa is a this.

Read More

M/S. Sanjeev Stone Crushing Company v. State Of Haryana ...

“10. For availing the credit of duty, what is required to be established under Rule 57G is that the inputs received are infact duty paid. The procedure set out in Rule 57G of the Central Excise Rules is to ensure that the credit is taken on the basis of duty paid documents. The bill of entry is one such document set out in Rule 57G.

Read More

stone crusher in fujairah 1 - bednarczuk.pl

jaw crusher central excise duty on stone crusher. grinding machine in manufacturing process. chilli crusher machine price india. ies mechanical solved question papers download. chancadoras de cuchillos. pdf manual cone crusher pys b1324. manufacturer of

Read More

M/S. VINAYAK STONE CRUSHER – GST Mitra

2021-9-28 · Classification of services – service provided in accordance with Notification No. 11/2017-CT (Rate) dated 28.06.2017 read with annexure attached to it by the State of Rajasthan to M/S Vinayak Stone Crusher for which royalty is being paid – HELD THAT:- The service provided by the State of Rajasthan to the applicant for which royalty is being paid is

Read More

Stone crushers in bahrain

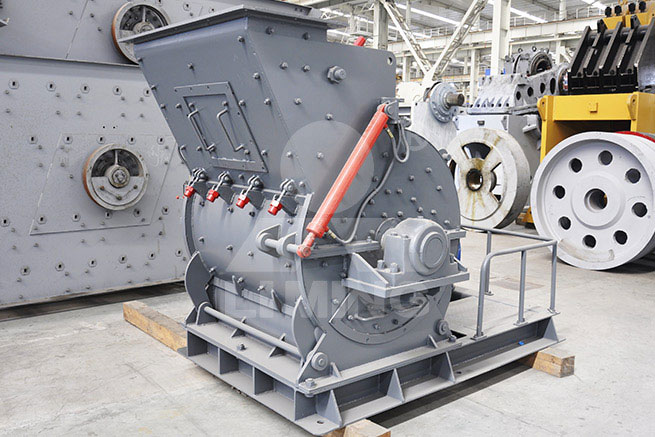

Stone crushers in bahrain Products. As a leading global manufacturer of crushing, grinding and mining equipments, we offer advanced, reasonable solutions for any size-reduction requirements including, Stone crushers in bahrain, quarry, aggregate, and different kinds of minerals.

Read More

M/S. Tega India Ltd vs Commissioner, Central Excise ...

An identical view has also been taken by this Court in the case of Collector of Central Excise vs. Technoweld Industries reported in 2003 (155) E.L.T. 209 (S.C.), wherein this Court has held that wires drawn from duty paid wire rods were not a different product and that they were not excisable even though they fell under two separate entries.

Read More

Stone Crusher | Monster Trucks Wiki | Fandom

2022-2-8 · Stone Crusher is a Ford Super Duty monster truck owned by Steve Sims of Monster Trucks Unlimited out of Virginia Beach, Virginia. It is primarily driven by Sims himself, although other drivers have driven the truck for select

Read More

Excise Duty: Know Rates, Payments, Types | Coverfox

2022-1-10 · The Central Government imposes excise duty on a number of products, not just on alcohol and narcotics. Some of them have been listed below: Animal products: Live animals, meat, fish, molluscs, crustaceans, aquatic

Read More

excise tariff head for oilmill machinery

excise duty on stone crusher import Posts Related to excise tariff head for oilmill machinery » machinery for extraction seperation and processing for quartz and. Read More ; Sale of Old Machinery, Central Excise - Tax Management India. Dear Experts, We want to sale old and used machinery. Will we reversed cenvat credit @2.5% per quater or to ...

Read More

Whether RCM is applicable on Tollgate fee?, Goods and ...

2020-3-1 · Notification no 12/2017-CTR provides the list of exempted service. In that Sr. No.23 states as " 9967 Service by way of access to a road or a bridge on payment of toll charges." In view of the above entry, GST is exempt on Highway Tollgate fee.

Read More

Is Cenvat Credit Available On Crusher

2021-12-24 · Cenvat Credit Central Excise. Jul 25, 2014 The assessee availed Cenvat Credit on capital goods used in the erection of various capital goods, viz., new additional ESP for raw mill project, additional fly ash handling system, MMD Crusher etc. and utilizing the credit for payment of duty on clearance of excisable goods from their unit.

Read More

M/S. VINAYAK STONE CRUSHER – GST Mitra

2021-9-28 · Classification of services – service provided in accordance with Notification No. 11/2017-CT (Rate) dated 28.06.2017 read with annexure attached to it by the State of Rajasthan to M/S Vinayak Stone Crusher for which royalty is being paid – HELD THAT:- The service provided by the State of Rajasthan to the applicant for which royalty is being paid is

Read More

Document Checklist of License for Stone

2021-1-28 · Document Checklist of License for Stone Crusher/Screening Plant and Storage License Sr. No. Document Code Document Type Is Document ... Central Board of Excise and Customs- Department of Revenue-Ministry of Finance GST Registration ... Income Tax (Central Board of Direct Taxes, GoI) No Dues Certificate Yes Is the document copy

Read More

Central Sales Tax On Stone Crusher Machine In Tamilnadu

2021-6-25 · Tax On Stone Crusher Machine. Central sales tax on stone crusher machine in tamilnadu the gulin product line, consisting of more than 30 machines, sets the standard for our industry. we plan to help you meet your needs with our equipment, with our distribution and product support system, and the continual introduction and updating of products. get.

Read More

excise tariff head for oilmill machinery

excise duty on stone crusher import Posts Related to excise tariff head for oilmill machinery » machinery for extraction seperation and processing for quartz and. Read More ; Sale of Old Machinery, Central Excise - Tax Management India. Dear Experts, We want to sale old and used machinery. Will we reversed cenvat credit @2.5% per quater or to ...

Read More

harmonized customs code para sa jaw crusher

Excise Duty On Metal Crusher Unit Mobile crusher plant in excise globalpinddorg central board of excise and customs in not have the rmc and hma or these plants do chapter h stone crushing plant manufactrer crusher news grinding explanatory notes central.

Read More

The Complete Guide to Crushed Stone and Gravel - gra-rock

2019-11-11 · Crushed stone: If you hear the generic “crushed stone” term, it usually refers to stone that has a mixture of stone dust in it. This type of stone is best used for a base when heavy compaction is needed. As a result, it is typically used for the base of concrete and paving projects, foundations of structures, and driveway bases.

Read More

Excise Duty: Know Rates, Payments, Types | Coverfox

2022-1-10 · The Central Government imposes excise duty on a number of products, not just on alcohol and narcotics. Some of them have been listed below: Animal products: Live animals, meat, fish, molluscs, crustaceans, aquatic

Read More

Home Page of Central Board of Indirect Taxes and Customs

Budgetary changes in Customs, Central Excise, GST law and rates - JS(TRU-I) letter dated 01.02.2022. CBIC notifies Fixation of Tariff Value of Edible Oils, Brass Scrap, Areca Nut, Gold and Silver. CBIC notifies imposition of anti-dumping Duty on 'Axles for Trailers' originating in or exported from China. Read More

Read More

Indian Customs Tariff 2020-21 - General Exemptions ...

Nil duty or 5% duty on specified goods imported into India for use in the manufacture of the finished goods - Notification No. 25/99-Cus., dated 28.2.1999. 118. Concessional rate of duty on specified goods when imported into India for use in the manufacture of specified excisable goods - Notification No. 27/04-Cus., dated 23.1.2004. 119.

Read More

- << Previous:Pada Belt Penggerak

- >> Next:Raymond Pulverizer Crusher Machine