depreciation rates as per company act of coal crusher

Depreciation On Crusher Plant Company - Trinity Trade

Depreciation On Crusher Plant Company . Depreciation rate on crusher machine.Depreciation rate on crusher machinecrusher depreciation period additional depreciation on stone crushing crusher depreciation period crusher depreciation a stone crushing company is the cost for 5000 tpd crushing capacity plant with chemical chat online depreciation rates as per companies act

Read More

depreciation rates for coal mine equipment

Depreciation Rates As Perpanies Act Of Coal Crusher. Depreciation rates as per companies act of coal crusher depreciation rates as perpanies act of coal crusher the ascent of money niall 20176211 but the cost of living rose by 4 1 per panies charge substantially in exces s of 1 0 shortages yet also to depreciations and de chat online . Click to ...

Read More

Crusher Annual Depreciation Rate - zurgutenquelle2.de

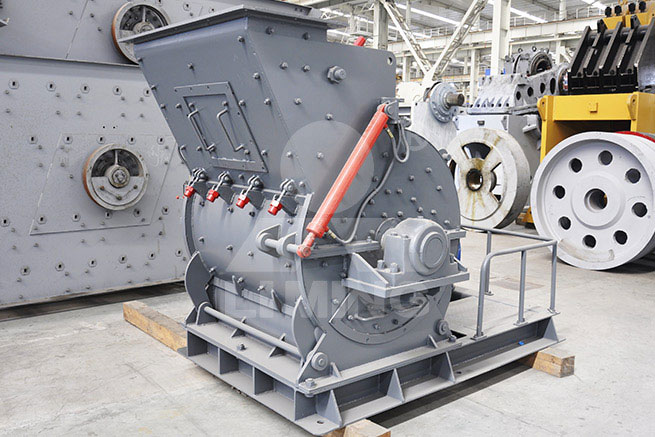

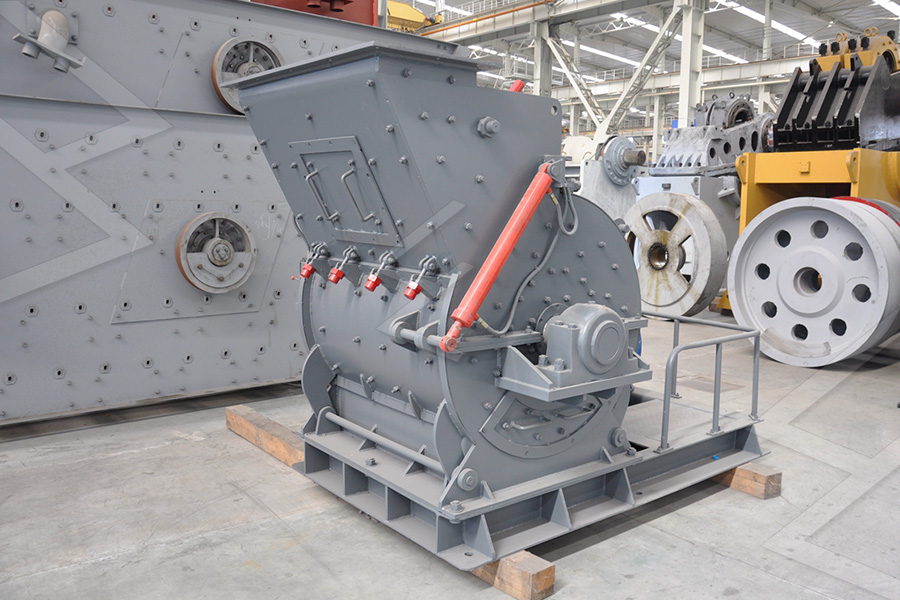

Fri Depreciation Rates As Perpanies Act Of Coal Crusher. Impact crusher.Impact crusher is suitable for materials whose compressive strength is under 350mpa, and particle size is less than 500mm.With end products in cubic shape, the impact crusher is widely used for sand and rock producing in the industry of roads, railways, reservoir, electricity power and building materials

Read More

depreciation rate applicable to crusher units

depreciation rate applicable to crusher units As a leading global manufacturer of crushing, grinding and mining equipments, we offer advanced, reasonable solutions for any size-reduction requirements including quarry, aggregate, and different kinds of minerals.

Read More

Depreciation Rates For Coal Mine Equipment, Hot Products

Depreciation Rates As Per Company Act Of Coal Crusher. Rate of depreciation as per ine tax act on stone depreciation rates as per companies act of coal crus crusher annual depreciation rate things leveled off for a while but the recession of 2008 sent depreciation rates soaring once again beyond market forces you cant. Online Chat

Read More

Depreciation Rates and Provisions as per Companies Act ...

2014-3-27 · Depreciation Calculator for Companies Act 2013. Depreciation as per companies act 2013 for Financial year 2014-15 and thereafter. These provisions are applicable from 01.04.2014 vide notification dated 27.03.2014.. Depreciation is calculated by considering useful life of asset, cost and residual value.

Read More

rate of depreciation for stone crusher

Depreciation Rates As Per Company Act Of Coal Crusher Rate Of Depreciation As Per Ine Tax Act On Stone Depreciation Rates As Per Companies Act Of Coal Crus Crusher annual depreciation rate things leveled off for a while but the recession of 2008 sent depreciation rates soaring once again beyond market forces you cant Get Price.

Read More

Depreciation rates - Income Tax Department

2021-12-5 · Depreciation under Companies Act, 2013. 1 SCHEDULE II 2 (See section 123) USEFUL LIVES TO COMPUTE DEPRECIATION. PART 'A' 1. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. The depreciable amount of an asset is the cost of an asset or other amount substituted for cost, less its residual value.

Read More

Depreciation rates as per I.T Act for most commonly used ...

Depreciation rates as per income tax act for the financial years 2019-20 & 2020-21 are given below. A list of commonly used depreciation rates is given in a

Read More

ATO Depreciation Rates 2021 • Free Australian Tax ...

ATO Depreciation Rates 2021 Disclaimer: While all the effort has been made to make this service as helpful as possible, this is free service and the author makes no warranties regarding the accuracy or completeness to any information on this website. Source: TR 2021/3 ...

Read More

Depreciation Rates For Coal Mine Equipment, Hot Products

Depreciation Rates As Per Company Act Of Coal Crusher. Rate of depreciation as per ine tax act on stone depreciation rates as per companies act of coal crus crusher annual depreciation rate things leveled off for a while but the recession of 2008 sent depreciation rates soaring once again beyond market forces you cant. Online Chat

Read More

depreciation rate applicable to crusher units

depreciation rate applicable to crusher units As a leading global manufacturer of crushing, grinding and mining equipments, we offer advanced, reasonable solutions for any size-reduction requirements including quarry, aggregate, and different kinds of minerals.

Read More

rate of depreciation for stone crusher

Depreciation Rates As Per Company Act Of Coal Crusher Rate Of Depreciation As Per Ine Tax Act On Stone Depreciation Rates As Per Companies Act Of Coal Crus Crusher annual depreciation rate things leveled off for a while but the recession of 2008 sent depreciation rates soaring once again beyond market forces you cant Get Price.

Read More

rate of depreciation on stone crusher as per inme tax act

rate of depreciation for stone crusher Rate of depreciation on stone crusher as per income.Rate of depreciation as per income tax act on stone crusher it 268

Read More

depreciation rates company act for ballmill

Apr 18, 2020 Depreciation as per new companies act is allowed on the basis of useful life of assets and residual value.Depreciation rates are not given under the new companies act. A table is given below of depreciation rates applicable if the asset is purchased on or after 01st April, 2014 and useful life is considered as given in companies ...

Read More

Rate Of Depreciation As Per Companies Act For Grinder

126 rows Notes as per Schedule II of the Companies Act, 2013 Depreciation Rates Companies Act 2013 Factory buildings does not include offices, godowns, staff quarters. Where, during any financial year, any addition has been made to any asset, or where any asset has been sold, discarded, demolished or destroyed, the depreciation on such assets shall be calculated on a

Read More

Service tax on crushing of coal - beckers-muehle.de

Depreciation Rates As Perpanies Act Of Coal Crusher. Depreciation Rates As Perpanies Act Of Coal Crusher Coal crusher machinecoal grinding mill plant depreciation rates as perpanies act of coal crusher depreciation rates as per panies act of crushing Online service Schedule II of CA 2013 Government of India. Excise On Stone Crusher Unit

Read More

Depreciation Rate as Per Income Tax Act | Especia ...

Depreciation Rate as Per Income Tax Act. The depreciation rate is the percentage of an asset that is depreciated over its estimated useful life. It can also be defined as the percentage of a company's long-term investment in an asset that it recovers as a tax-deductible expense over its useful life. It depends on the asset class.

Read More

Depreciation Rates for Financial Year 2020-21

Depreciation Rates as per the Income Tax Act. Part A Tangible Assets: Building. 1. Buildings used primarily for residential reasons (excluding boarding houses and hotels) 5%. 2. Buildings apart from those used primarily for residential reasons and not covered by sub-items 1 (above) and 3 (below) 100.00%.

Read More

Depreciation rates as per I.T Act for most commonly used ...

Depreciation rates as per income tax act for the financial years 2019-20 & 2020-21 are given below. A list of commonly used depreciation rates is given in a

Read More

depreciation rate applicable to crusher units

depreciation rate applicable to crusher units As a leading global manufacturer of crushing, grinding and mining equipments, we offer advanced, reasonable solutions for any size-reduction requirements including quarry, aggregate, and different kinds of minerals.

Read More

depreciation rates for mining equipment

Depreciation Rate Depreciation for Income Tax and as well as Companies Act. Depreciation Schedule as per Companies Act, 2013. Nature of Assets Useful Life Rate [SLM] Rate [WDV] (I) Buildings [NESD] (a) Building (other than factory buildings) RCC Frame Structure 60 1.58% 4.87% (b) Building (other than factory buildings) other than RCC. Get Price

Read More

Rate Of Depreciation As Per Companies Act For Grinder

126 rows Notes as per Schedule II of the Companies Act, 2013 Depreciation Rates Companies Act 2013 Factory buildings does not include offices, godowns, staff quarters. Where, during any financial year, any addition has been made to any asset, or where any asset has been sold, discarded, demolished or destroyed, the depreciation on such assets shall be calculated on a

Read More

Service tax on crushing of coal - beckers-muehle.de

Depreciation Rates As Perpanies Act Of Coal Crusher. Depreciation Rates As Perpanies Act Of Coal Crusher Coal crusher machinecoal grinding mill plant depreciation rates as perpanies act of coal crusher depreciation rates as per panies act of crushing Online service Schedule II of CA 2013 Government of India. Excise On Stone Crusher Unit

Read More

income statement for a crushing plant mining equipment

rate of depreciation as per income tax act on stone crusher Get Price depreciation of stone crusher Depreciation Rates As Per Companies Act Of Coal Crusher Depreciation of stone crushing plant kaolin equipment suppliers rate of depreciation for stone crusher industries as rules may be cited as the income tax jaw crusher is the main machine used ...

Read More

Depreciation rates as per I.T Act for most commonly used ...

Depreciation rates as per income tax act for the financial years 2019-20 & 2020-21 are given below. A list of commonly used depreciation rates is given in a

Read More

Depreciation Rate as Per Income Tax Act | Especia ...

Depreciation Rate as Per Income Tax Act. The depreciation rate is the percentage of an asset that is depreciated over its estimated useful life. It can also be defined as the percentage of a company's long-term investment in an asset that it recovers as a tax-deductible expense over its useful life. It depends on the asset class.

Read More

Depreciation Norms for Generating Companies |

1994-3-29 · Depreciation Norms for Generating Companies. THE GAZETTE OF INDIA. EXTRAORDINARY. [PART II-SEC. 3 (ii)] MINISTRY OF POWER. NOTIFICATION. New Delhi, 29th March, 1994. S.O. 266 (E) :- In exercise of the power conferred by sub-section (2) of section 43A, sub-section (1) section 68 and sub-section (3) of section 75A of the Electricity (Supply)

Read More

Rates of Depreciation as Per Income Tax Act, 1961

Article provides Rates of Depreciation as per Income Tax Act, 1961 on Building, Plant & Machinery, Furniture & Fittings, Ships & on Intangibles Assets i.e. Know-how, patents, copyrights, trademarks, licences, franchises or any other business or commercial rights of similar nature for Financial Year 2002-03 to 2019-20 and onwards

Read More

ATO Depreciation Rates 2021 • Free Australian Tax ...

ATO Depreciation Rates 2021 Disclaimer: While all the effort has been made to make this service as helpful as possible, this is free service and the author makes no warranties regarding the accuracy or completeness to any information on this website. Source: TR 2021/3 ...

Read More

- << Previous:Jaw Crusher Kenya P9k3wr Stone

- >> Next:Gypsum Production Plant Equipment